Know Your Customer Solution & KYC Software

Enforcio software as KYC solution is an invaluable tool for professionals in legal, accounting, and real estate sectors, offering benefits such as compliance assurance, risk management, fraud prevention, and enhanced efficiency in client interactions. It supports these professionals in maintaining a secure and trustworthy business environment while ensuring adherence to regulatory standards.

Our KYC software Enforcio is based on pre-screening, and designed to streamline the initial stages of the client onboarding process by automating the verification of customer information before formal onboarding.

What you gain from Enforcio KYC solution:

Enforcio configured to check client data against regulatory requirements, and this ensures that the initial stages of client onboarding are in compliance with relevant regulations.

Automated pre-screening will enable you to perform basic risk assessments before committing to a full customer relationship. And this also will help in identifying high-risk individuals early in the onboarding process, allowing for more focused due diligence.

By automating the pre-screening process, you will reduce the manual effort required for basic client checks and speed up the client onboarding process. By automating the initial checks, you will quickly assess whether a potential client meets the basic criteria, allowing for faster decision-making.

KYC solution

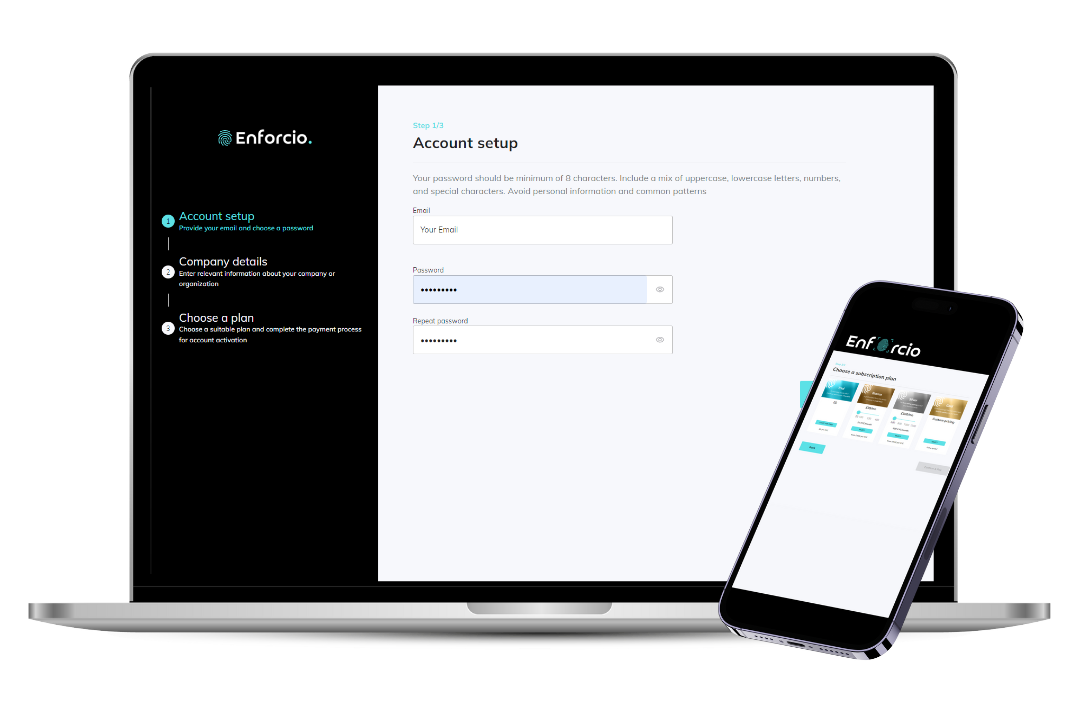

Automate your KYC & Onboarding process.

Get fast results with Enforcio, cost-efficient KYC software for ID verification, AML Compliance and Onboarding.

Onboard your clients in seconds!

Client onboarding made easy with Enforcio that automates verification, evaluates risk, and simplifies compliance with evolving regulations, such as AML and KYC checks.

Fight fraud during customer onboarding.

Prevent fraud before it can cause real harm to your business, and reduce the time to verify genuine customers.

Protect your business when making new partnerships.

Uncover any risks to your firm that could arise from doing business with certain clients and prevent financial crime with Enforcio.

PRICING & PLANS 2025

Bronze

from £99/month

A great solution for a one-person company or small team

3-400 KYC/month

from £0.62 per KYC

Silver

from £300/month

The best-selling package to suit your business needs

401-1200 KYC/month

from £0.38 per KYC

INDUSTRIES

Designed by AML specialists for a wide range of small businesses, susceptible to the risk of being exploited for money laundering or illicit financial activities such as Real Estate Agencies, Legal and Accounting Firms.

Enforcio software helps automate, streamline and standardize Know Your Customer (KYC) process

Our software helps Accountants to make informed anti-money laundering decisions by automating processes and helping them to carry out due diligence

Our simple, cost-effective solution makes anti money laundering for estate agents easy

FAQ about KYC solutions UK

What is KYC and its purpose?

KYC, or Know Your Customer, is a set of processes and procedures that businesses and financial institutions implement to verify and identify their clients or customers. The primary objective is to ensure that organizations have sufficient information about their clients to assess the associated risks, comply with regulations, and prevent illegal activities such as money laundering and fraud.

What are the types of KYC?

KYC processes can vary based on the industry, jurisdiction, and specific requirements of the business. KYC is not a one-size-fits-all concept, and different types of KYC are implemented to address the unique needs and risks associated with various sectors. Here are some common types of KYC:

- Basic KYC: this is the standard KYC process that involves collecting and verifying essential information about the customer, such as name, address, date of birth, and government-issued identification documents.

- Enhanced KYC (e-KYC): it involves using advanced technologies and electronic means for identity verification. It may include biometric authentication, electronic document verification, and other electronic identity verification methods.

- Customer Due Diligence (CDD): it is a more in-depth form of KYC that involves a thorough analysis of the customer’s background, financial history, and business activities. It aims to understand the nature of the customer’s transactions and assess the risk associated with the business relationship.

- Simplified Due Diligence (SDD): it is applied in cases where the risk of money laundering or terrorist financing is deemed to be low. It involves reduced KYC requirements for customers with lower risk profiles.

- Ongoing KYC: it involves continuously monitoring customer transactions and activities throughout the business relationship. This ensures that any changes in the customer’s risk profile are promptly identified.

- Transaction Monitoring: it is a specific type of KYC that focuses on monitoring individual transactions in real-time. It aims to identify unusual patterns or behaviors that may indicate potential money laundering or fraud.

- Source of Funds (SOF) Verification: this type of KYC involves verifying the source of funds used in financial transactions. It helps ensure that the funds being used are legitimate and not associated with illegal activities.

- Beneficial Ownership Verification: this focuses on identifying and verifying the beneficial owners of legal entities, such as companies or trusts. Understanding the ownership structure helps prevent the misuse of legal entities for illicit purposes.

- Sector-Specific KYC: different industries may have specific KYC requirements tailored to their characteristics and risks. For example, financial institutions, real estate, legal, and gaming sectors may implement sector-specific KYC processes.

- Regulatory KYC: this involves complying with specific KYC requirements mandated by regulatory authorities. Financial institutions and businesses must adhere to regulatory standards to prevent money laundering and ensure compliance with the law.

- Cross-Border KYC: this type of KYC is applicable to transactions involving customers from different countries. It may include additional verification steps to comply with international regulations and standards.

- High-Risk KYC: it is applied to customers or transactions deemed to have a higher risk of involvement in money laundering or illicit activities. Enhanced due diligence measures are often implemented in high-risk cases.

It’s essential for businesses to tailor their KYC processes based on the nature of their operations, industry-specific risks, and regulatory requirements. The goal is to strike a balance between effective risk management and a smooth customer onboarding experience. Additionally, advancements in technology, such as artificial intelligence and machine learning, are increasingly being leveraged to enhance the efficiency and accuracy of KYC processes.

Key components of KYC procedure

Customer Identification: collecting and verifying information to accurately identify the customer. This includes details such as name, date of birth, address, and identification numbers.

Risk Assessment: evaluating the risk associated with a customer or transaction. This involves determining the likelihood of the customer being involved in illicit activities and the potential impact on the organization.

Customer Due Diligence (CDD): conducting a comprehensive analysis of the customer’s background, financial history, and business activities. CDD helps in understanding the nature of the customer’s transactions and ensures compliance with regulatory requirements.

Enhanced Due Diligence (EDD): additional scrutiny for higher-risk customers or transactions. EDD involves a more in-depth analysis of the customer’s profile, including source of funds, business relationships, and potential exposure to politically exposed persons (PEPs).

Identity Verification: confirming the customer’s identity through reliable and secure methods. This may include document verification, biometric authentication, or electronic identity verification.

Ongoing Monitoring: continuously monitoring customer transactions and activities to identify any unusual or suspicious behavior. Ongoing monitoring ensures that the customer’s risk profile is regularly updated.

Record Keeping: maintaining detailed records of customer information, transactions, and due diligence processes. Proper record-keeping is essential for compliance and audit purposes.

Transaction Monitoring: utilizing automated systems to monitor transactions in real-time, flagging any unusual patterns or activities that may indicate potential fraud or illicit behavior.

Regulatory Compliance: adhering to local and international regulations governing customer identification and anti-money laundering (AML) practices. KYC procedures are designed to ensure compliance with these regulatory requirements.

Staff Training: providing training to employees involved in customer interactions and KYC processes. Ensuring that staff members are aware of the importance of KYC helps maintain the integrity of the procedure.

Key components of KYC procedure

Customer Identification: collecting and verifying information to accurately identify the customer. This includes details such as name, date of birth, address, and identification numbers.

Risk Assessment: evaluating the risk associated with a customer or transaction. This involves determining the likelihood of the customer being involved in illicit activities and the potential impact on the organization.

Customer Due Diligence (CDD): conducting a comprehensive analysis of the customer’s background, financial history, and business activities. CDD helps in understanding the nature of the customer’s transactions and ensures compliance with regulatory requirements.

Enhanced Due Diligence (EDD): additional scrutiny for higher-risk customers or transactions. EDD involves a more in-depth analysis of the customer’s profile, including source of funds, business relationships, and potential exposure to politically exposed persons (PEPs).

Identity Verification: confirming the customer’s identity through reliable and secure methods. This may include document verification, biometric authentication, or electronic identity verification.

Ongoing Monitoring: continuously monitoring customer transactions and activities to identify any unusual or suspicious behavior. Ongoing monitoring ensures that the customer’s risk profile is regularly updated.

Record Keeping: maintaining detailed records of customer information, transactions, and due diligence processes. Proper record-keeping is essential for compliance and audit purposes.

Transaction Monitoring: utilizing automated systems to monitor transactions in real-time, flagging any unusual patterns or activities that may indicate potential fraud or illicit behavior.

Regulatory Compliance: adhering to local and international regulations governing customer identification and anti-money laundering (AML) practices. KYC procedures are designed to ensure compliance with these regulatory requirements.

Staff Training: providing training to employees involved in customer interactions and KYC processes. Ensuring that staff members are aware of the importance of KYC helps maintain the integrity of the procedure.