“Say goodbye to tedious and time-consuming paperwork and reduce errors:

Enforcio automates key steps in the KYC process, ensures compliance with regulatory requirements, and enhances the overall client experience”

Streamline your client onboarding process with ENFORCIO

A time-consuming client onboarding process can frustrate prospective clients, potentially dissuading them from engaging with the company. Onboarding serves as the initial encounter clients have with a business and is a crucial step in safeguarding both the company and its clientele from fraud and illicit activities.

So, what precisely is client onboarding process? It refers to the customer due diligence process mandated for financial institutions and regulated entities before establishing a relationship with a new client.

To counteract fraudulent activities and shield against legal and financial consequences, businesses must verify customer identities for authenticity. However, the challenge lies in crafting an onboarding process that is both efficient and seamless while adhering to Anti-Money Laundering regulations. Client onboarding tool Enforcio helps to achieve this goal.

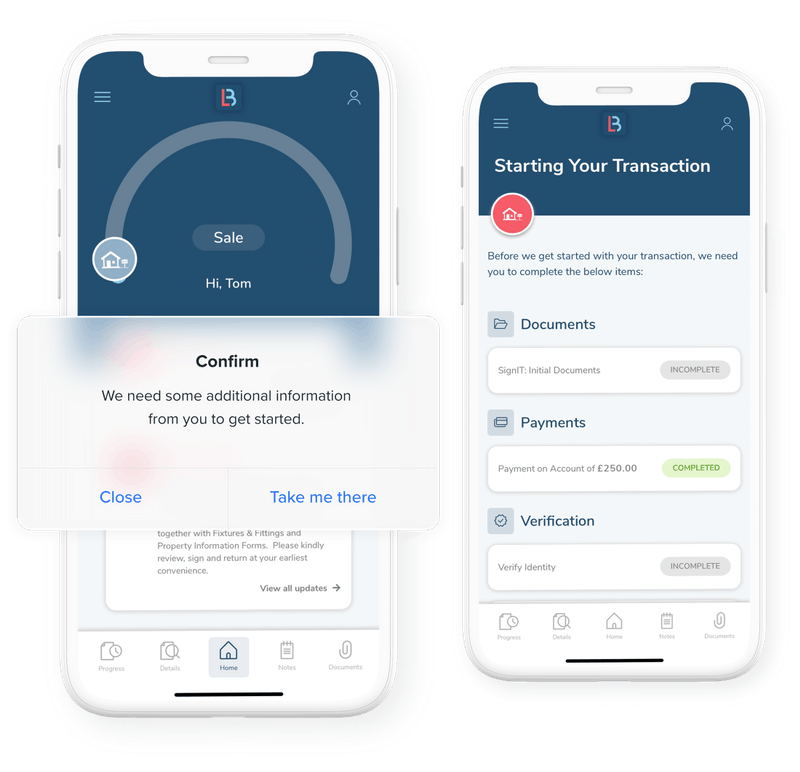

Easy-to-use onboarding software

5 simple steps: Setup your account, fill it out with Clients’ details, choose your plan, choose risk management and start eKYC process

A risk-based approach in KYC processes

Enforcio onboarding tool offers a risk-based approach to KYC comliance that efficiently focuses resources on higher risk clients and ensures lifecycle compliance with KYC regulations

Pay only for what you need

Reap the benefits of our product’s flexibility and adjust it to your business needs, from £0.5 to £4.95 per KYC Check

Know Your Customer (KYC) tool

Automate your KYC & Onboarding process.

Get fast results with Enforcio, cost-efficient KYC software for ID verification, AML Compliance and Onboarding.

Client onboarding tool

Onboard your clients in seconds!

Client onboarding made easy with Enforcio that automates verification, evaluates risk, and simplifies compliance with evolving regulations, such as AML and KYC checks.

Fraud Prevention tool

Fight fraud during customer onboarding.

Prevent fraud before it can cause real harm to your business, and reduce the time to verify genuine customers.

Due Diligence (CDD) tool

Protect your business when making new partnerships.

Uncover any risks to your firm that could arise from doing business with certain clients and prevent financial crime with Enforcio.

PRICING & PLANS

Trial

£0

Try out today, decide after! Check our process with 20 FREE KYC

20 KYC

£0 per KYC

Bronze

£249/month

A great solution for a one-person company or small team

400 KYC/month

from £4.95 per KYC

Silver

£300/month

The best-selling package to suit your business needs

600 KYC/month

from £0.50 per KYC

Gold

Custom Pricing

The most convenient, bespoke solution for your team

Get a quote!

INDUSTRIES

Designed by AML specialists for a wide range of small businesses, susceptible to the risk of being exploited for money laundering or illicit financial activities such as Real Estate Agencies, Legal and Accounting Firms.

Legal sector

Enforcio software helps automate, streamline and standardize Know Your Customer (KYC) process

Accountancy sector

Our software helps Accountants to make informed anti-money laundering decisions by automating processes and helping them to carry out due diligence

Property sector

Our simple, cost-effective solution makes anti money laundering for estate agents easy

FAQ

What is client onboarding?

Client onboarding is the process through which a business or financial institution welcomes and integrates new clients or customers into its systems, services, and operations.

This is a critical phase in building a relationship with clients, ensuring that they have a positive experience from the start, and meeting regulatory requirements.

Client onboarding is particularly important in industries such as finance, banking, investment, and professional services where compliance, security, and transparency are crucial.

Why is client onboarding so important?

- Compliance with Regulations:

Client onboarding is essential for ensuring compliance with various legal and regulatory requirements. Financial institutions, in particular, must adhere to regulations such as Anti-Money Laundering (AML), Know Your Customer (KYC), and other financial industry standards. Proper onboarding helps in verifying the identity of clients and mitigating the risk of illicit activities.

- Risk Management:

Assessing and managing risk is a fundamental aspect of client onboarding. By evaluating the risk associated with each client, businesses can implement appropriate risk management strategies, allocate resources effectively, and safeguard against potential fraud or financial losses.

- Enhanced Security and Fraud Prevention:

Verifying client information during onboarding contributes to enhanced security measures. This helps prevent identity theft, fraud, and other illicit activities that may harm both the client and the business. Robust onboarding processes act as a deterrent to fraudulent activities.

- Building Trust and Credibility:

A smooth and transparent onboarding experience helps build trust and credibility with clients. It sets the tone for a positive relationship, showcasing the organization’s professionalism, commitment to compliance, and dedication to providing a secure and reliable service.

- Efficient Service Delivery:

Proper onboarding ensures that clients have access to the services they require in a timely and efficient manner. This contributes to a positive client experience, reducing the likelihood of dissatisfaction and churn.

- Customization of Services:

Understanding the client’s needs and preferences during onboarding allows businesses to tailor their services accordingly. This customization can lead to increased client satisfaction and long-term loyalty.

- Effective Risk Communication:

During the onboarding process, businesses have the opportunity to communicate effectively with clients regarding risks, terms and conditions, and expectations. Clear communication helps manage client expectations and fosters a transparent and open relationship.

- Operational Efficiency:

Streamlining the onboarding process contributes to operational efficiency. Automated systems and workflows can reduce manual errors, save time, and enable organizations to handle a larger volume of clients more effectively.

- Regulatory Reporting and Auditing:

A well-documented onboarding process aids in regulatory reporting and auditing. In the event of an audit, having a clear record of the onboarding procedures and client information can demonstrate compliance with regulatory requirements.

- Long-Term Relationship Building:

The initial onboarding experience sets the foundation for a long-term relationship between the business and the client. Positive onboarding experiences contribute to client satisfaction, loyalty, and the likelihood of repeat business.

Digital client onboarding, what is that?

Digital client onboarding refers to the process of bringing new clients into a business or service using digital channels and technology. By embracing digital client onboarding, businesses can reduce manual paperwork, enhance efficiency, and provide a more seamless experience for their clients. It also contributes to better compliance and security practices in handling sensitive client information.

The client onboarding softwares typically include features such as data collection, verification, documentation, and communication tools to ensure a smooth and efficient onboarding experience. Algorithms may be incorporated into these platforms to enhance various aspects of the onboarding process. Here are some key components and algorithmic considerations in client onboarding software:

- Data Collection and Validation:

Algorithmic Matching: Use algorithms to match and verify client-provided information against existing databases or external sources for accuracy and legitimacy.

Data Quality Algorithms: Implement algorithms to assess the quality and completeness of the data provided by clients.

- Identity Verification:

Biometric Algorithms: Integrate biometric authentication algorithms for enhanced security, using fingerprint, facial recognition, or other biometric data.

Document Verification: Algorithms can be used to verify the authenticity of documents submitted by clients.

- Risk Assessment:

Risk Scoring Algorithms: Assess the risk associated with a new client based on various factors, such as their financial history, industry, or geographic location.

- Workflow Automation:

Process Automation Algorithms: Streamline the onboarding workflow by automating repetitive tasks and decision-making processes using algorithms.

- Compliance Checks:

Regulatory Compliance Algorithms: Ensure that the onboarding process adheres to legal and regulatory requirements by implementing algorithms that check for compliance.

- Communication and Notifications:

Automated Communication Algorithms: Implement algorithms for automated communication, such as sending welcome emails or notifications to clients at different stages of the onboarding process.

- Personalization:

Personalization Algorithms: Customize the onboarding experience based on client profiles and preferences using algorithms that analyze client data.

- Analytics and Reporting:

Analytics Algorithms: Use algorithms to generate insights from onboarding data, helping businesses identify areas for improvement and optimize their processes.

- Cybersecurity:

Security Algorithms: Employ algorithms to detect and prevent potential security threats during the onboarding process, such as fraud detection algorithms.

- Integration with Existing Systems:

Data Mapping Algorithms: Facilitate seamless integration with existing systems by employing algorithms that map and transform data between different formats and structures.

When selecting or developing client onboarding software, it’s crucial to consider the specific needs of your business, industry regulations, and the level of security required. Additionally, ongoing monitoring and updates to algorithms should be part of the software’s maintenance to adapt to evolving threats and regulatory changes.