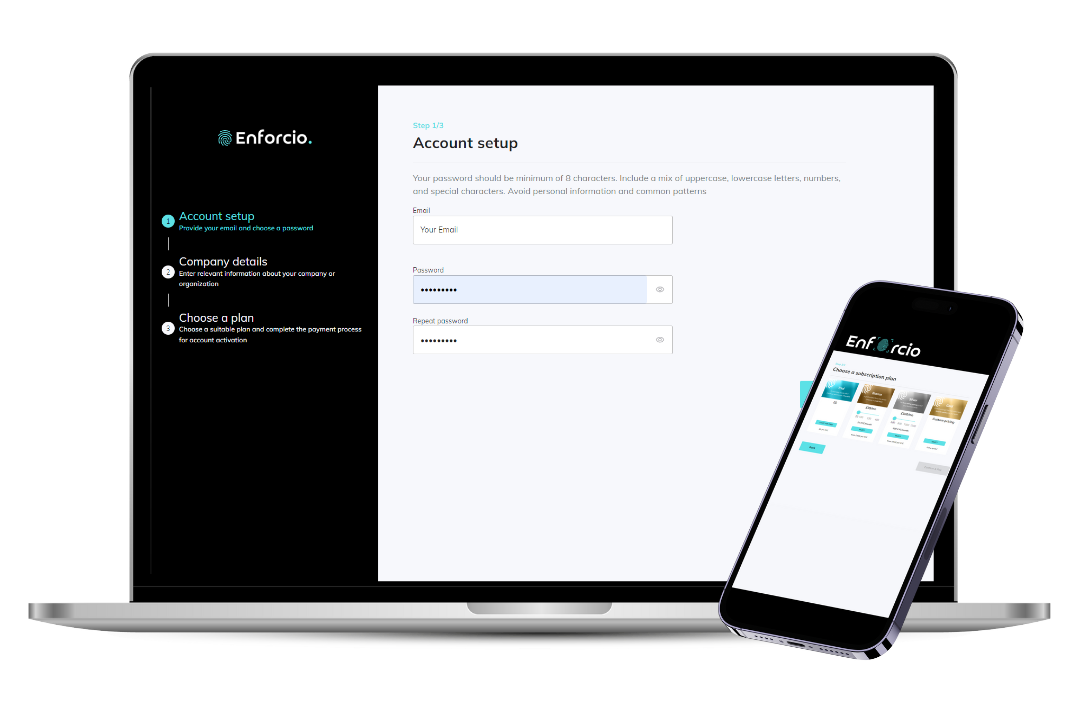

Automate your KYC & Onboarding process.

Get fast results with Enforcio, cost-efficient KYC software for ID verification, AML Compliance and Onboarding.

Onboard your clients in seconds!

Client onboarding made easy with Enforcio that automates verification, evaluates risk, and simplifies compliance with evolving regulations, such as AML and KYC checks.

Fight fraud during customer onboarding.

Prevent fraud before it can cause real harm to your business, and reduce the time to verify genuine customers.

Protect your business when making new partnerships.

Uncover any risks to your firm that could arise from doing business with certain clients and prevent financial crime with Enforcio.

Minimum Effort To Stay KYC & AML Compliant

All in One Advanced Platform

ENFORCIO platform includes: Know Your Customer (KYC), Сlient onboarding tool, Fraud prevention tool & Due diligence tool

From £0.38 per KYC Check

Carry Out KYC Checks with minimal friction & most trusted analytics

Real-Time Verification

Easy to use platform. Verify your customers in seconds!

Bronze

from £99/month

A great solution for a one-person company or small team

3-400 KYC/month

from £0.62 per KYC

Silver

from £300/month

The best-selling package to suit your business needs

401-1200 KYC/month

from £0.38 per KYC

Designed by AML specialists for a wide range of small businesses, susceptible to the risk of being exploited for money laundering or illicit financial activities such as Real Estate Agencies, Legal and Accounting Firms.

Enforcio software helps automate, streamline and standardize Know Your Customer (KYC) process

Our software helps Accountants to make informed anti-money laundering decisions by automating processes and helping them to carry out due diligence

Our simple, cost-effective solution makes anti money laundering for estate agents easy

Interested, but have more questions?

Please contact our support team!

Enforcio will make sure your company keeps up with ever-changing AML regulations. Whether your prospective client is a corporation or an individual, our all-in-one AML solution covers every base, so your business is protected. Our efficient, automated platform performs a wide range of UK anti-money laundering checks.

AML KYC checks: all you need to know, 2025

What are anti-money laundering checks?

Anti-Money Laundering (AML) checks during client onboarding are procedures implemented by businesses and financial institutions to prevent their services from being used for money laundering or other illicit financial activities.

These checks are a crucial component of the client onboarding process, ensuring compliance with regulatory requirements and mitigating the risk of financial crime.

Conducting AML checks during client onboarding is not only a regulatory requirement but also a critical step in safeguarding the business, maintaining compliance, and building trust with clients.

It is an integral part of responsible and ethical business practices, particularly in industries where financial transactions are central to operations.

Why are AML checks necessary?

AML checks are necessary during client onboarding to comply with legal and regulatory requirements, prevent financial crime, mitigate risks, protect reputation, and contribute to the overall integrity and security of the financial system.

They are an essential part of responsible and ethical business practices, particularly in industries where financial transactions are central to operations.

AML checks as part of KYC. What are KYC checks?

Anti-Money Laundering checks are an integral component of Know Your Customer (KYC) processes in the financial industry.

KYC is a set of procedures and policies designed to verify the identity of customers, assess their risk profile, and prevent financial institutions from being used for illicit activities, including money laundering and terrorism financing. KYC checks are essential for regulatory compliance, risk management, and maintaining the integrity of the financial system.

By understanding their customers, businesses can identify and mitigate potential risks, prevent financial crimes, and contribute to a secure and transparent financial environment.

What information do you need to complete an AML check?

Completing an Anti-Money Laundering (AML) check involves gathering comprehensive information about the customer to verify their identity, assess the risk associated with their activities, and ensure compliance with AML regulations. The specific information required may vary based on the industry, and the risk profile of the customer. Here are common elements needed to complete an AML check:

- Personal Information: Full legal name: Including any aliases or variations; Date of birth: To confirm the individual’s age and identity.

- Contact Information: Residential address: The current and, if applicable, previous addresses; Email address; Phone number.

- National Identification Documents: Passport: A valid passport is a commonly accepted form of identification; Driver’s license: In some cases, a driver’s license may be accepted; National ID card: Issued by the government and containing a photo.

- Proof of Address: Utility bills: Recent bills such as electricity, water, or gas bills; Bank statements: Showing recent transactions and the customer’s address; Rental or mortgage agreement: Documenting the residential arrangement.

- Business Information (if applicable): Legal business name; Business registration number; Registered address.

- Ownership Structure (for Companies): Details of beneficial owners: Names, addresses, and percentage of ownership; Corporate structure: Information about subsidiaries, parent companies, and affiliates.

- Source of Funds: Explanation of the source of funds used in transactions; Details about the customer’s occupation and income; Documentation supporting the legitimacy of the funds.

- Transaction Details: Information about the nature and purpose of the business relationship.

- Expected transaction volume; Types of transactions expected.

- Politically Exposed Persons (PEP) Status: Information about any connections to individuals holding prominent public positions; Clarification if the customer is a PEP or has close associations with PEPs.

- Enhanced Due Diligence (EDD) Information (for High-Risk Customers): Additional information about the customer’s background and business activities; Documentation supporting the rationale for considering the customer as high risk.

- Consent and Authorization: Obtain customer consent for conducting AML checks and storing their information; Authorization to perform periodic reviews and updates.

- Record-keeping Documentation: Comprehensive records of the AML check process, including all documents collected and actions taken.

The Legal Framework Governing AML checks

In the United Kingdom, Anti-Money Laundering (AML) checks are governed by a comprehensive legal framework aimed at preventing money laundering and the financing of terrorism. The key pieces of legislation and regulations that form the legal foundation for AML checks in the UK include:

The Money Laundering, Terrorist Financing, and Transfer of Funds (Information on the Payer) Regulations 2017; The Proceeds of Crime Act 2002 (POCA); The Terrorism Act 2000; The Criminal Finances Act 2017; Financial Conduct Authority (FCA) Rules; The Sanctions and Anti-Money Laundering Act 2018 (SAMLA); The Office for Professional Body Anti-Money Laundering Supervision (OPBAS); and National Crime Agency (NCA).

Which businesses must register for AML checks?

In the United Kingdom, various types of businesses are required to register for Anti-Money Laundering (AML) checks. The regulatory framework is governed by the Money Laundering, Terrorist Financing, and Transfer of Funds (Information on the Payer) Regulations 2017, which transposes the EU’s Fourth Money Laundering Directive into UK law.

The following businesses are generally obligated to register for AML checks in the UK: Financial Institutions, Money Service Businesses, Cryptocurrency Exchanges, High-Value Dealers, Professional Service Providers (Lawyers, solicitors, and law firms; Accountants & accounting firms; and Tax advisers), Estate Agents, Trust and Company Service Providers, Casinos and Gambling Services, Prepaid Card Issuers, Charities and Non-Profit Organizations, Pawnbrokers, Art Market Participants, Vehicle Sellers, Auction Houses, Precious Metal Dealers, and Shipping Agents.

AML Check Process

In the United Kingdom, the AML check process involves Customer Identification, Risk Assessment, Politically Exposed Persons (PEP) Screening, Enhanced Due Diligence (EDD), Source of Funds Verification, Transaction Monitoring, Global Watchlist Screening, Record-keeping, Regulatory Reporting, and Integration with KYC Processes.

What are the penalties for failing to complete AML checks?

In the United Kingdom, failing to complete AML checks or not complying with AML regulations can result in significant penalties and legal consequences. The penalties may vary depending on the severity of the breach and the specific circumstances. Here are some potential penalties for non-compliance with AML regulations in the UK:

- Fines: Regulatory authorities, such as the Financial Conduct Authority (FCA) or the Office for Professional Body Anti-Money Laundering Supervision (OPBAS), have the authority to impose fines on businesses that fail to comply with AML regulations; Fines can be substantial and may vary based on the severity of the breach. They are often calculated as a percentage of the business’s turnover or can be a fixed amount.

- Criminal Prosecution: Serious breaches of AML regulations may lead to criminal prosecution. Individuals within the organization, such as directors or employees, may face charges, and the business itself may be subject to legal action.

- Loss of License or Authorization: Businesses in regulated sectors, such as financial services, may risk losing their license or authorization to operate if they repeatedly fail to comply with AML regulations. This can have severe consequences for the business’s ability to conduct its operations.

- Civil Liability: Non-compliance with AML regulations can expose businesses to civil liability. This means that affected parties, such as customers or other businesses, may take legal action to seek damages for any harm caused by the failure to comply with AML requirements.

- Reputational Damage: AML non-compliance can result in significant reputational damage. Negative publicity and loss of trust can harm the business’s relationships with customers, partners, and stakeholders.

- Remedial Actions: Regulatory authorities may require businesses to take specific remedial actions to address deficiencies in their AML processes. This could include implementing enhanced controls, conducting additional training, or making organizational changes.

- Monitoring and Supervision: Regulatory authorities may increase their monitoring and supervision of businesses that have a history of AML non-compliance. This heightened scrutiny can add operational burdens and costs.

- Director Disqualification: Directors and responsible individuals within an organization may face disqualification from serving as directors if they are found to be involved in or responsible for AML breaches.