Enforcio Due Diligence solution offers a risk-based approach to KYC comliance that efficiently focuses resources on higher risk clients and ensures lifecycle compliance with KYC regulations

Enforcio software as Due Diligence solution

Enforcio Due Diligence solution with a pre-screening focus offers small businesses a systematic and efficient way to conduct initial assessments, enabling them to make well-informed decisions about whether to proceed with more extensive due diligence processes.

Customer Due Diligence, its purpose:

Risk Mitigation: Identify and manage risks associated with customers.

Compliance: Fulfil legal and regulatory requirements.

Prevent Financial Crimes: Detect and prevent money laundering, terrorist financing, and other illicit activities.

Pay only for what you need

Reap the benefits of our product’s flexibility and adjust it to your business needs, from £0.38 per KYC Check

Automate your KYC & Onboarding process.

Get fast results with Enforcio, cost-efficient KYC software for ID verification, AML Compliance and Onboarding.

Onboard your clients in seconds!

Client onboarding made easy with Enforcio that automates verification, evaluates risk, and simplifies compliance with evolving regulations, such as AML and KYC checks.

Fight fraud during customer onboarding.

Prevent fraud before it can cause real harm to your business, and reduce the time to verify genuine customers.

Due Diligence solution

Protect your business when making new partnerships.

Uncover any risks to your firm that could arise from doing business with certain clients and prevent financial crime with Enforcio.

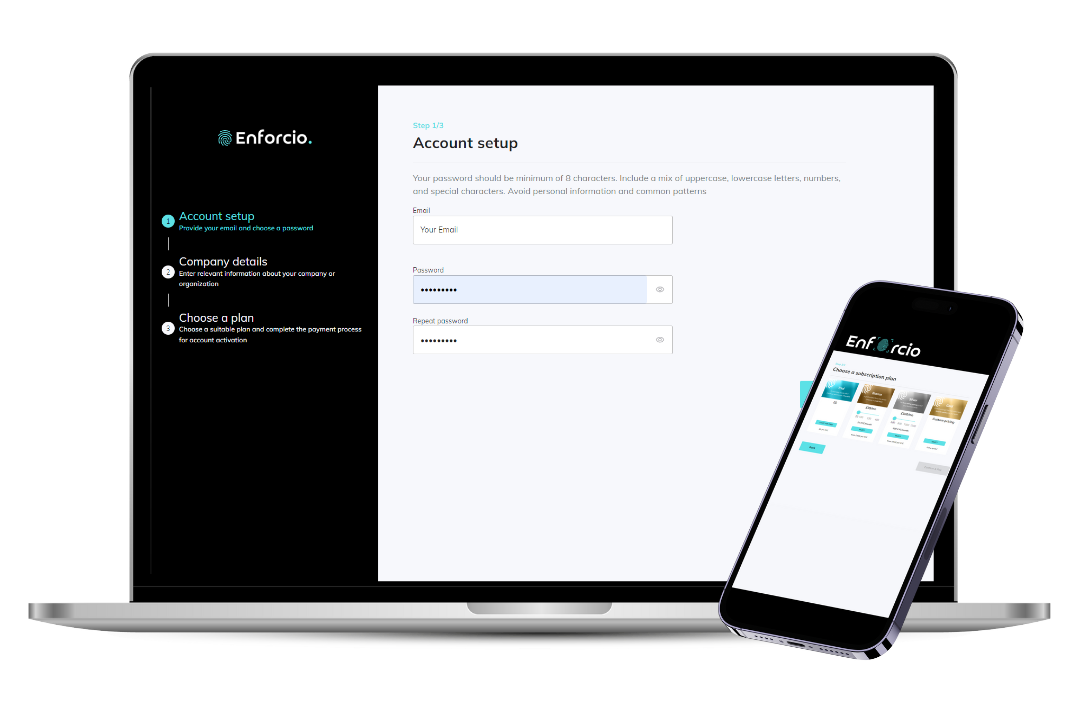

Trial

£0

Try out today, decide after! Check our process with 2 FREE KYC

2 KYC

£0 per KYC

Bronze

from £99/month

A great solution for a one-person company or small team

3-400 KYC/month

from £0.62 per KYC

Silver

from £300/month

The best-selling package to suit your business needs

401-1200 KYC/month

from £0.38 per KYC

Gold

Custom Pricing

The most convenient, bespoke solution for your team

Get a quote!

Designed by AML specialists for a wide range of small businesses, susceptible to the risk of being exploited for money laundering or illicit financial activities such as Real Estate Agencies, Legal and Accounting Firms.

Enforcio software helps automate, streamline and standardize Know Your Customer (KYC) process

Our software helps Accountants to make informed anti-money laundering decisions by automating processes and helping them to carry out due diligence

Our simple, cost-effective solution makes anti money laundering for estate agents easy

FAQ

What is Customer Due Diligence (CDD)?

Customer Due Diligence (CDD) is a process undertaken by businesses, especially in the financial and regulated sectors, to assess and understand their customers’ backgrounds, risks, and behaviors. The primary goal is to prevent financial crimes such as money laundering, terrorist financing, and fraud.

Is the Customer Due Diligence an integral part of the Know Your Customer (KYC) process?

Yes, Customer Due Diligence (CDD) is indeed an integral part of the Know Your Customer (KYC) process. KYC refers to the set of procedures and policies that businesses, particularly in the financial industry, implement to verify and identify their customers. The primary goal of KYC is to prevent illegal activities such as money laundering, fraud, and terrorist financing.

CDD specifically involves gathering and assessing information about a customer to understand their risk profile. This includes verifying the customer’s identity, understanding the nature of their business or financial transactions, and assessing the risk they pose in terms of money laundering or other illicit activities.

CDD helps institutions to have a comprehensive understanding of their customers, enabling them to make informed decisions, manage risks effectively, and comply with regulatory requirements. It involves ongoing monitoring of customer transactions and activities to ensure that the customer’s risk profile is up to date and that any unusual or suspicious behavior is promptly identified and reported.

Due Diligence softwares, types

Due diligence software refers to tools and platforms that facilitate the process of due diligence, which is the comprehensive assessment and investigation of a business or individual before entering into a transaction or agreement. Due diligence is commonly performed in mergers and acquisitions, investments, partnerships, and other business transactions to mitigate risks and ensure informed decision-making. Here are some types of due diligence software and their functionalities:

- Virtual Data Rooms (VDRs):

Purpose: Securely store and share confidential documents during due diligence processes.

Features: Document encryption, access controls, activity tracking, and audit trails.

- Compliance and Risk Assessment Software:

Purpose: Evaluate legal and regulatory compliance, identify potential risks.

Features: Automated risk assessments, compliance tracking, regulatory updates.

- Financial Due Diligence Software:

Purpose: Analyze financial statements, conduct financial modeling, and assess financial health.

Features: Financial analysis tools, forecasting, budgeting.

- Contract Management Software:

Purpose: Manage and review contracts to identify potential liabilities and obligations.

Features: Contract tracking, version control, search and analysis tools.

- Business Intelligence (BI) Tools:

Purpose: Analyze and visualize data to gain insights into the target company’s performance.

Features: Data visualization, analytics, dashboards.

- Cybersecurity Due Diligence Software:

Purpose: Assess the target’s cybersecurity posture and identify potential vulnerabilities.

Features: Vulnerability scanning, threat intelligence, risk assessments.

- Customer Due Diligence (CDD) Software:

Purpose: Verify the identity of customers and assess the risk of potential business relationships.

Features: Identity verification, risk profiling, compliance checks.

- Environmental, Social, and Governance (ESG) Software:

Purpose: Evaluate the target’s performance in environmental, social, and governance aspects.

Features: ESG reporting, sustainability tracking, impact assessment.

- Due Diligence Automation Platforms:

Purpose: Streamline and automate the due diligence process for efficiency.

Features: Workflow automation, document indexing, collaboration tools.

When selecting due diligence software, consider the specific requirements of your due diligence process, the nature of the transaction, and the industry in which you operate. Additionally, ensure that the software complies with relevant legal and regulatory standards to maintain the integrity and confidentiality of the information being processed.