01.

Comply with

Laws & Regulations

Demonstrate compliance with legal requirements, rules, and regulations to regulatory bodies.

02.

Improve your

Corporate Performance

Reduce time, effort, and cost by standardizing and automating your risk and compliance management processes.

03.

Identify

Emerging Risks

By regularly performing a formal risk assessment, you can get a clear picture of what potential threats might exist.

What is Enforcio KYC software?

A risk-based approach in KYC processes allows organisations to strike a balance between compliance requirements and operational efficiency. It ensures that the level of due diligence is proportionate to the perceived risk, making the onboarding process more adaptive, resource-efficient, and scalable. By focusing on higher-risk customers, organizations can enhance the effectiveness of their compliance program. This targeted approach helps in identifying and preventing potential issues associated with customers who pose a greater risk of involvement in financial crimes.

Efficient Onboarding

Low-risk customers can undergo a streamlined onboarding process. With a risk-based approach, organizations can allocate resources more efficiently by focusing enhanced due diligence efforts on higher-risk customers.

Resource Optimization

The risk-based approach allows organizations to allocate resources in proportion to the assessed risk. This helps in optimizing operational costs and streamlining compliance efforts by prioritizing higher-risk scenarios for more thorough verification.

Tailored Due Diligence

High-risk customers receive a more comprehensive due diligence process. This tailored approach ensures that the level of scrutiny matches the perceived risk, helping organizations to identify and mitigate potential compliance issues associated with these customers.

Scalability

As organizations grow and onboard a larger customer base, a risk-based approach provides a scalable solution. Automated systems can adapt to handle varying risk levels, ensuring that compliance procedures remain effective and adaptable to changing circumstances.

Adaptability to Regulatory Changes

The risk-based approach is flexible and can be adjusted to meet evolving regulatory requirements. Organizations can adapt their KYC processes to align with changes in compliance standards while still prioritizing resources based on risk levels.

Reduced Customer Friction

Low-risk customers experience a smoother onboarding process, reducing unnecessary friction. This positive experience can contribute to customer satisfaction and loyalty.

Explore our KYC Solutions

Automate your KYC & Onboarding process.

Get fast results with Enforcio, cost-efficient KYC software for ID verification, AML Compliance and Onboarding.

Protect your business when making new partnerships.

Uncover any risks to your firm that could arise from doing business with certain clients and prevent financial crime with Enforcio.

Onboard your clients in seconds!

Client onboarding made easy with Enforcio that automates verification, evaluates risk, and simplifies compliance with evolving regulations, such as AML and KYC checks.

Fight fraud during customer onboarding.

Prevent fraud before it can cause real harm to your business, and reduce the time to verify genuine customers.

A risk-based approach in KYC processes

A risk-based approach in KYC processes allows organisations to strike a balance between compliance requirements and operational efficiency. It ensures that the level of due diligence is proportionate to the perceived risk, making the onboarding process more adaptive, resource-efficient, and scalable.

Reduce Risk and Manage KYC Compliance

Future-proof compliance with Enforcio continuous risk monitoring process and risk-based approach to KYC.

Improve Operational Efficiencies

Streamlining the KYC process with automation and straight-through processing reduces the manual rekeying of data, the possibility of human errors and operational costs.

Reduce Total Cost of Ownership

Delivered as a SaaS solution, Enforcio reduces the costs of managing and maintaining technology infrastructure and “cost to change” budget, reducing application, support and configuration costs.

Delivered as a SaaS solution, Enforcio reduces the costs of managing and maintaining technology infrastructure and “cost to change” budget, reducing application, support and configuration costs.

KYC risk-based approach helps enable a better customer onboarding compliance program as it adjusts the verification levels based on risk factors. Low-risk customers are more quickly accepted, while higher-risk customers can have additional verification procedures added.

Thus, it is essential to categorize every customer from their ML/FT risk quotient to detect and prevent such risks effectively.

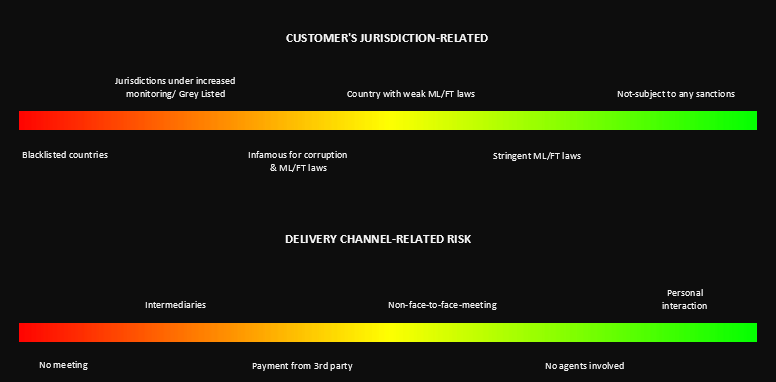

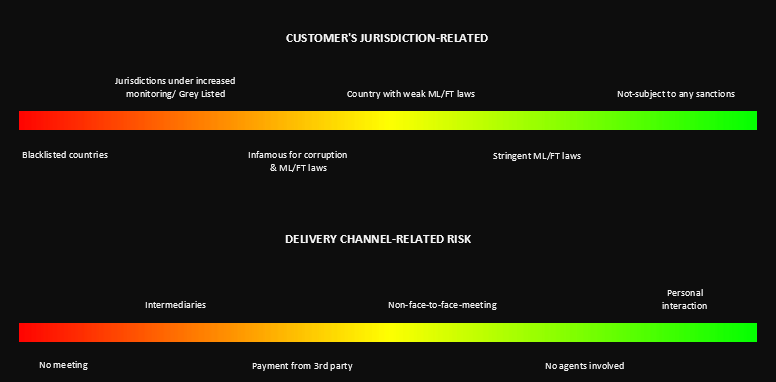

You need to factor in a bundle of risk parameters to create customers’ AML risk profiles. To help you efficiently assess the ML/FT risk posed by each of your customers (as Low, Medium, High, or Unacceptable), we have designed an infographic illustrating the factors to be considered to perform Customer Risk Assessment from an AML perspective.

The strength of the risk-based approach are to provide you with a framework to understand risk and an operational plan for dealing with it. Risk will always be a factor whenever there’s the possibility of money laundering. You can effectively manage AML risks and better serve societal imperatives by taking a systematic approach.

Bronze

from £99/month

A great solution for a one-person company or small team

3-400 KYC/month

from £0.62 per KYC

Silver

from £300/month

The best-selling package to suit your business needs

401-1200 KYC/month

from £0.38 per KYC

Designed by AML specialists for a wide range of small businesses, susceptible to the risk of being exploited for money laundering or illicit financial activities such as Real Estate Agencies, Legal and Accounting Firms

Enforcio software helps automate, streamline and standardize Know Your Customer (KYC) process

Our software helps Accountants to make informed anti-money laundering decisions by automating processes and helping them to carry out due diligence

Our simple, cost-effective solution makes anti money laundering for estate agents easy

What is Enforcio?

Enforcio is an online platform designed for professionals regulated and operating in the United Kingdom to enable them to service their clients in fulfilling their anti-money laundering obligations.

The platform consists of a proprietary algorithm that carries out an automated risk assessment once the customer completes an online onboarding form which takes only a few minutes.

Enforcio allows the professional to assign different rights to users and to keep a full audit of all the risk assessments carried out, approved and rejected. The system also allows the uploading of due diligence documents and also integration with international databases on subject persons and their ongoing monitoring.

Who is Enforcio’ client onboarding platform for?

Designed by AML specialists for a wide range of businesses, susceptible to the risk of being exploited for money laundering or illicit financial activities such as Real Estate Agencies (Estate Agents & Property Companies, and Property Developers & Property development firms), Legal (lawyers & solicitors) and Accounting Firms (accountancy & advisory firms, and sole practitioners).

Exclusively for Professionals:

- Lawyers

- Auditors

- Accountants

- Real Estate Agents

How does Enforcio protect my business?

By using Enforcio, you automatically have access to a range of features allowing you to manage your onboarding processes with total peace of mind. These include user consent capture, links to your privacy policy, data privacy control dashboard, and much more.

What is the main feature of Enforcio?

Enforcio consists of a proprietary algorithm that carries out an automated risk assessment once the customer completes an online onboarding form.

A risk-based approach in KYC processes, it allows organisations to strike a balance between compliance requirements and operational efficiency. It ensures that the level of due diligence is proportionate to the perceived risk, making the onboarding process more adaptive, resource-efficient, and scalable.

The risk management is based on Customer Risk Assessment (“CRA”) methodology.

The CRA methodology defines the blueprint that is used to stratify clients by risk. The methodology includes identifying the factors that go into a risk assessment, the scores allocated to each risk factor and how the various risk scores are rolled up into an overall customer risk score.

Risk factors typically include attributes related to the client, jurisdiction, service/product, and delivery channel.

For every risk factor, defined what values are to be considered high, medium, or low risk, it is implemented via a scoring system of low, medium, high based on how risky it is.

- The aggressive appetite entails the most lenient approach to Know Your Customer (“KYC”) analysis and client onboarding.

Choose this level for the rapid customer acquisition, while maintaining full compliance with KYC regulations. - The balanced appetite is a middle ground, combining thorough scrutiny with a degree of flexibility.

Choose this level if you are seeking a pragmatic balance between security and user convenience. - The conservative appetite is characterized by the most meticulous and cautious approach to KYC analysis.

Choose this level if your top priority is a risk mitigation.

How secure is Enforcio?

Yes, Enforcio is a secure and reliable solution for your business and your customers.

Enforcio implements a transparent and systemized customer onboarding process that allows you to professionally manage and scale your company workflows.

Enforcio is complying with the GDPR, which is setting a new gold standard of Data protection, if not the highest in the world.