Enforcio is a dedicated client onboarding software for accountants that helps businesses identify new clients with minimum of friction.

Onboarding is the beginning of your business relationship with a client, and it is crucial to consider anti-money laundering (AML) regulations from the start.

Many accountants still use outdated onboarding processes, typically collecting just basic client information and a passport copy, unaware that these steps are insufficient for AML compliance.

Why should you follow AML regulations?

Complying with AML regulations is essential to maintaining the integrity and trustworthiness of the accounting profession. Non-compliance can result in severe penalties, including fines, disciplinary action, and even imprisonment. A comprehensive onboarding process and thorough client due diligence are necessary to verify a client’s identity, understand their business activities, and assess the nature and purpose of the relationship. This ensures you can effectively manage risks related to money laundering, terrorist financing, and proliferation financing.

All in One Advanced Platform

Enforcio platform includes: Know Your Customer (KYC), Сlient onboarding tool, Fraud prevention tool and Due diligence tool

From £0.38 per KYC Check

Carry Out KYC Checks with minimal friction & most trusted analytics

Real-Time Verification

Easy to use platform. Verify your customers in seconds

01.

Gather detailed information about the client’s identity, business activities, the purpose of the business relationship, and the source of funds.

For companies and other organizations, identify the ultimate beneficial owner (UBO) who controls the client.

02.

Evaluate Risks: Conduct an initial risk assessment based on the collected information. Consider factors such as the client’s business activities, industry, geographic location, ownership structure, and exposure to high-risk jurisdictions or individuals.

03.

Adjust Based on Risk: Use the risk assessment to determine the level of due diligence required. High-risk clients may need enhanced due diligence, including more detailed background checks and increased monitoring.

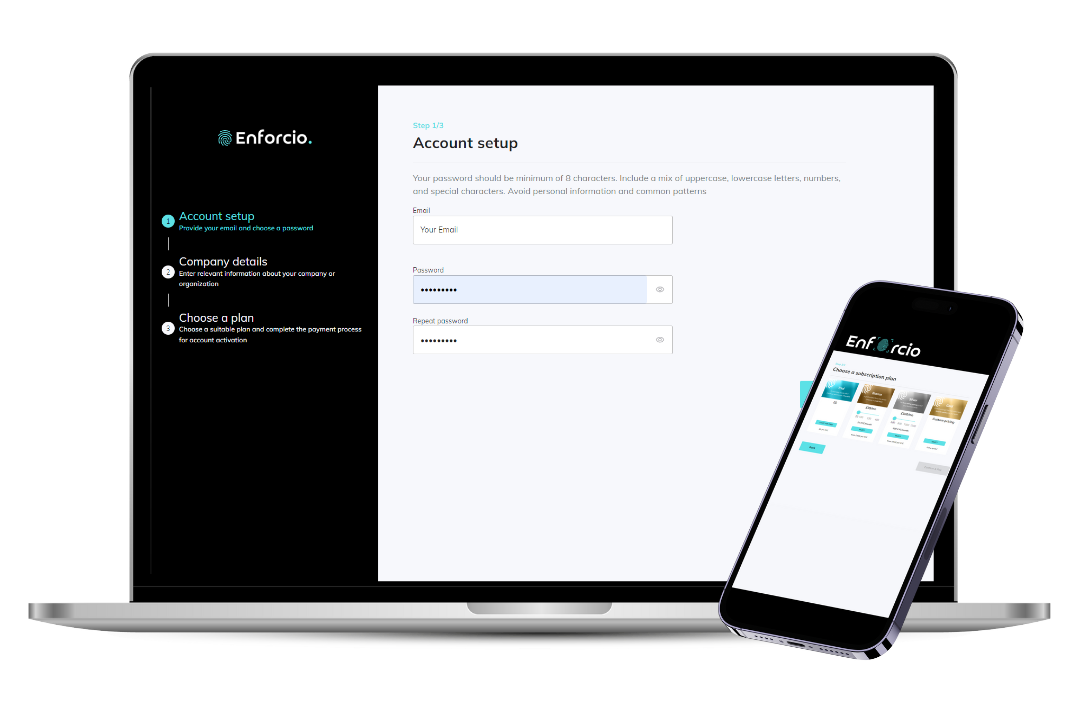

Automate your KYC & Onboarding process.

Get fast results with Enforcio, cost-efficient KYC software for ID verification, AML Compliance and Onboarding.

Onboard your clients in seconds!

Client onboarding made easy with Enforcio that automates verification, evaluates risk, and simplifies compliance with evolving regulations, such as AML and KYC checks.

Fight fraud during customer onboarding.

Prevent fraud before it can cause real harm to your business, and reduce the time to verify genuine customers.

Protect your business when making new partnerships.

Uncover any risks to your firm that could arise from doing business with certain clients and prevent financial crime with Enforcio.

PRICING & PLANS 2025Client Onboarding software for Accountants

Bronze

from £99/month

A great solution for a one-person company or small team

3-400 KYC/month

from £0.62 per KYC

Silver

from £300/month

The best-selling package to suit your business needs

401-1200 KYC/month

from £0.38 per KYC

Designed by AML specialists for a wide range of small businesses, susceptible to the risk of being exploited for money laundering or illicit financial activities such as Real Estate Agencies, Legal and Accounting Firms

Enforcio software helps automate, streamline and standardize Know Your Customer (KYC) process

Accountancy sector

Our software helps Accountants to make informed anti-money laundering decisions by automating processes and helping them to carry out due diligence

Our simple, cost-effective solution makes anti money laundering for estate agents easy