All in One Advanced Platform

Enforcio platform includes: Know Your Customer (KYC), Сlient onboarding tool, Fraud prevention tool and Due diligence tool

From £0.5 per KYC Check

Carry Out KYC Checks with minimal friction & most trusted analytics

Real-Time Verification

Easy to use platform. Verify your customers in seconds

The market for risk management solutions is diverse, with various solutions offering different features, functionalities, and approaches. If you are looking for a risk management solutions that incorporate robust risk assessment tools, it would be a right decision to choose the software capable to evaluate and classify the risk associated with each client, helping you make informed decisions regarding onboarding and ongoing monitoring.

The main distinctive feature of Enforcio risk management platform is a KYC risk-based approach that offers a strategic and adaptable framework for customer onboarding compliance. It ensures that the level of verification aligns with the perceived risk associated with each customer, striking a balance between compliance requirements and operational efficiency.

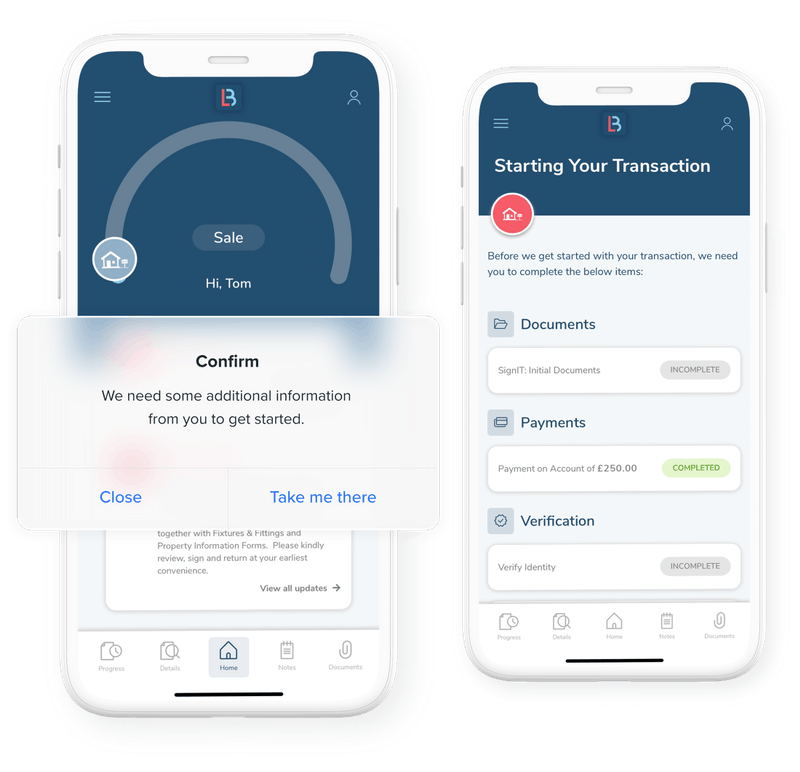

Know Your Customer (KYC) tool

Automate your KYC & Onboarding process.

Get fast results with Enforcio, cost-efficient KYC software for ID verification, AML Compliance and Onboarding.

Client onboarding tool

Onboard your clients in seconds!

Client onboarding made easy with Enforcio that automates verification, evaluates risk, and simplifies compliance with evolving regulations, such as AML and KYC checks.

Fraud Prevention tool

Fight fraud during customer onboarding.

Prevent fraud before it can cause real harm to your business, and reduce the time to verify genuine customers.

Due Diligence (CDD) tool

Protect your business when making new partnerships.

Uncover any risks to your firm that could arise from doing business with certain clients and prevent financial crime with Enforcio.

Trial

£0

Try out today, decide after! Check our process with 20 FREE KYC

20 KYC

£0 per KYC

Bronze

£249/month

A great solution for a one-person company or small team

400 KYC/month

from £4.95 per KYC

Silver

£300/month

The best-selling package to suit your business needs

600 KYC/month

from £0.50 per KYC

Gold

Custom Pricing

The most convenient, bespoke solution for your team

Get a quote!

Designed by AML specialists for a wide range of small businesses, susceptible to the risk of being exploited for money laundering or illicit financial activities such as Real Estate Agencies, Legal and Accounting Firms

Legal sector

Enforcio software helps automate, streamline and standardize Know Your Customer (KYC) process

Accountancy sector

Our software helps Accountants to make informed anti-money laundering decisions by automating processes and helping them to carry out due diligence

Property sector

Our simple, cost-effective solution makes anti money laundering for estate agents easy